Real estate valuation is a complex blend of art and science, and it requires a deep understanding of the market, property specifics, and financial modeling. Each property is unique, so to most accurately determine a property’s value the choice of valuation method depends on its characteristics. This also means it’s crucial to account for variables like the discount rate and residual cap rate, which can have a significant impact on valuation outcomes.

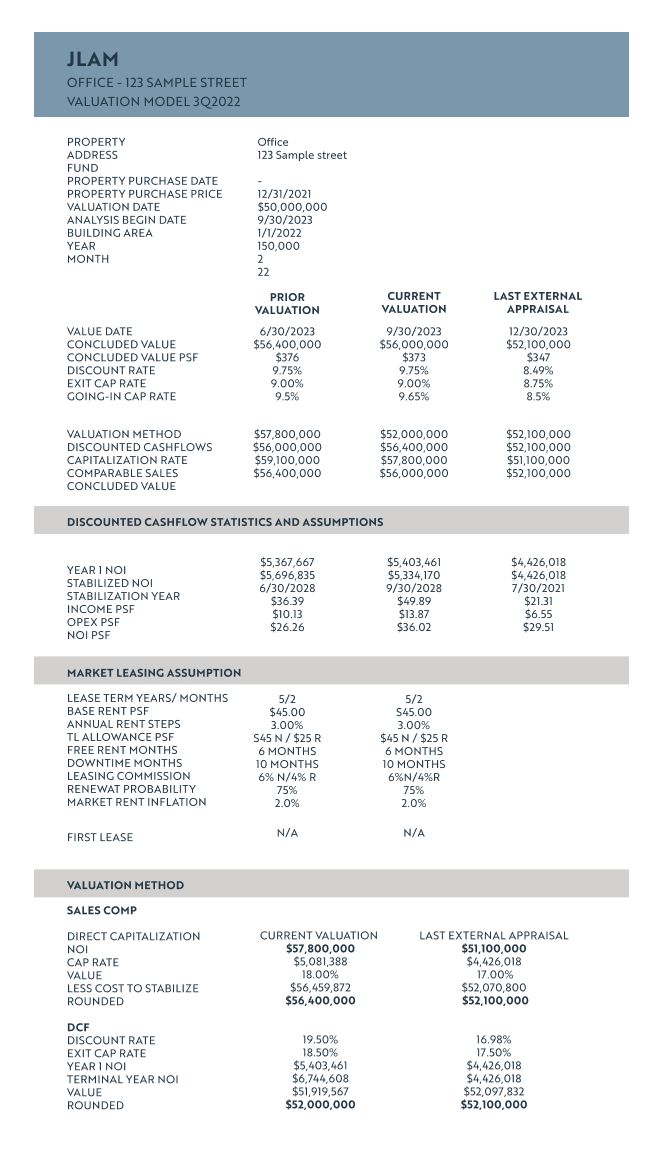

Our approach at JLAM is rooted in precision and transparency. We use the most accurate data available, relying on reliable sources and a team of experienced professionals. In fact, we use four different valuation models to provide accurate and comprehensive property valuations. These models are sales comps, direct cap rate, discounted cash flow (DCF), and external appraisal. Read more to learn about each method and understand how we arrive at property valuations.

Why does JLAM create valuations?

In line with IPEV Guidelines, Fair Value is defined as the price an asset would fetch or a liability would require in an orderly transaction between Market Participants under current market conditions. It’s the foundation for valuing investments. JLAM’s private equity real estate investments are recorded at Fair Value or at amounts closely approximating Fair Value. This provides transparency and reliability in financial statements.The IFRS categorizes Fair Value measurements into Level I, Level II, or Level III, based on the observability of inputs. While Level I and Level II are not applicable to JLAM’s investments, Level III plays a significant role, particularly in valuing private real estate investments. Level III are assets that are illiquid and not often traded, which makes them hard to value and why we use the four valuations models (since there typically is no current market value to them).With this in mind, here are how we use the different valuation methods.

Sales Comparisons

Sales comparisons (comps) are a fundamental part of our valuation process. This method involves analyzing recent sales of properties similar to the one being evaluated. Sales comps provide a snapshot of what the market currently considers the value of the property. However, this method has its limitations—because it relies on the quantity, quality, and relevance of the comparable sales data, it is subject to availability of recent, similar sales transactions. If the market conditions have undergone significant changes recently, sales comps will be unable to illustrate this. This method is also subject to a lag, as actual transactions can sometimes take 3-6 months to be recorded, and thus may not capture then-current market dynamics.

Direct Cap Rate

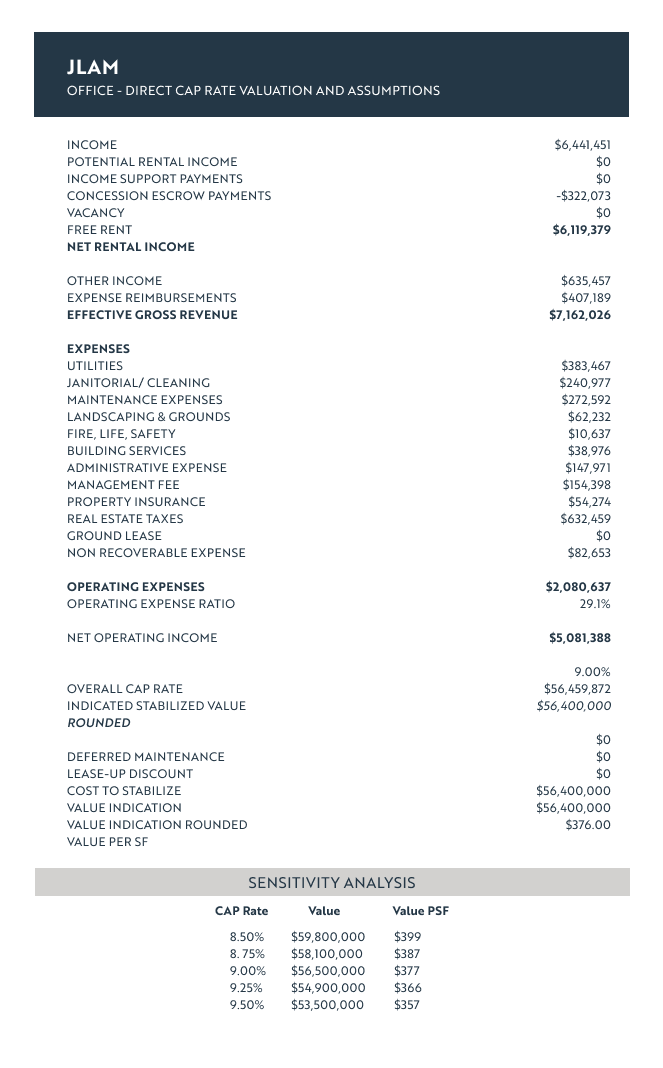

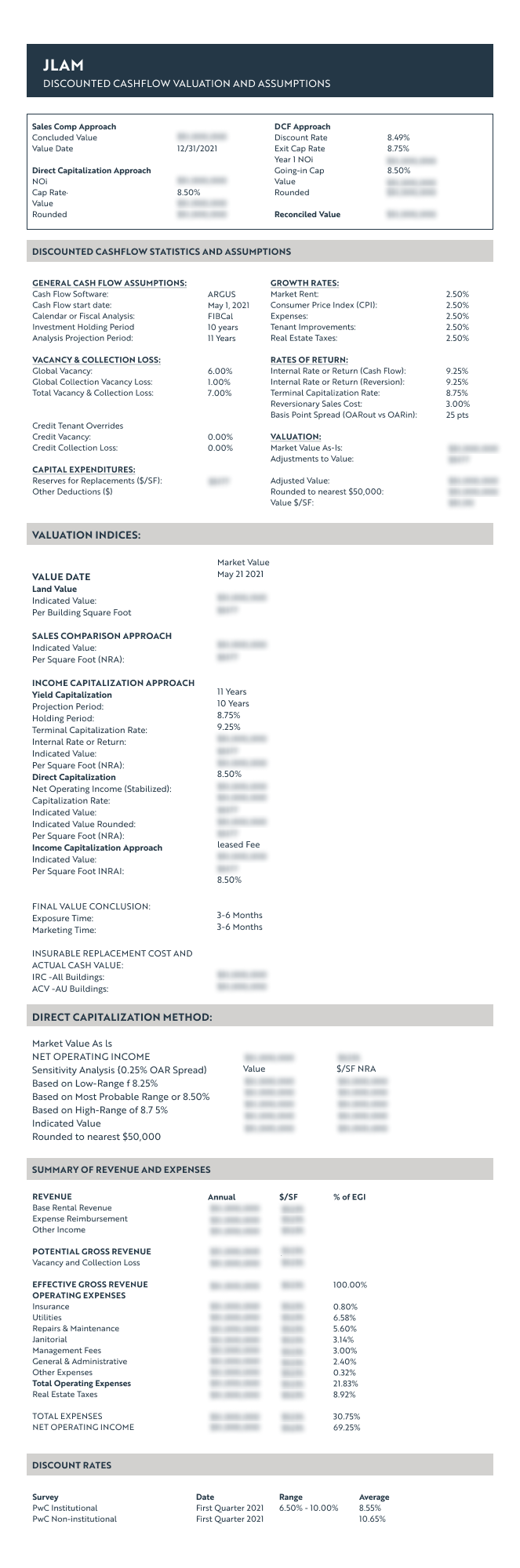

The direct cap rate method takes a forward-looking approach by evaluating the property’s current value based on the projected net operating income (NOI) for the next 12 months. This means considering the expected rental income and operating expenses (and applying necessary adjustments for required capital expenditures) over the next year. It provides a quick snapshot of the property’s value if it were to be sold today. The direct cap rate value is determined by dividing the NOI by a relevant cap rate, which is influenced by market factors. This method relies heavily on the accuracy of the cap rate used. It’s a useful approach when you’re buying a property based on the next year’s expected income. However, there are some limitations to this method including it may not accurately reflect the growth potential (for example—if leases were scheduled to increase by 10% in 13 months, that would not be accounted for).

Discounted Cash Flow (DCF)

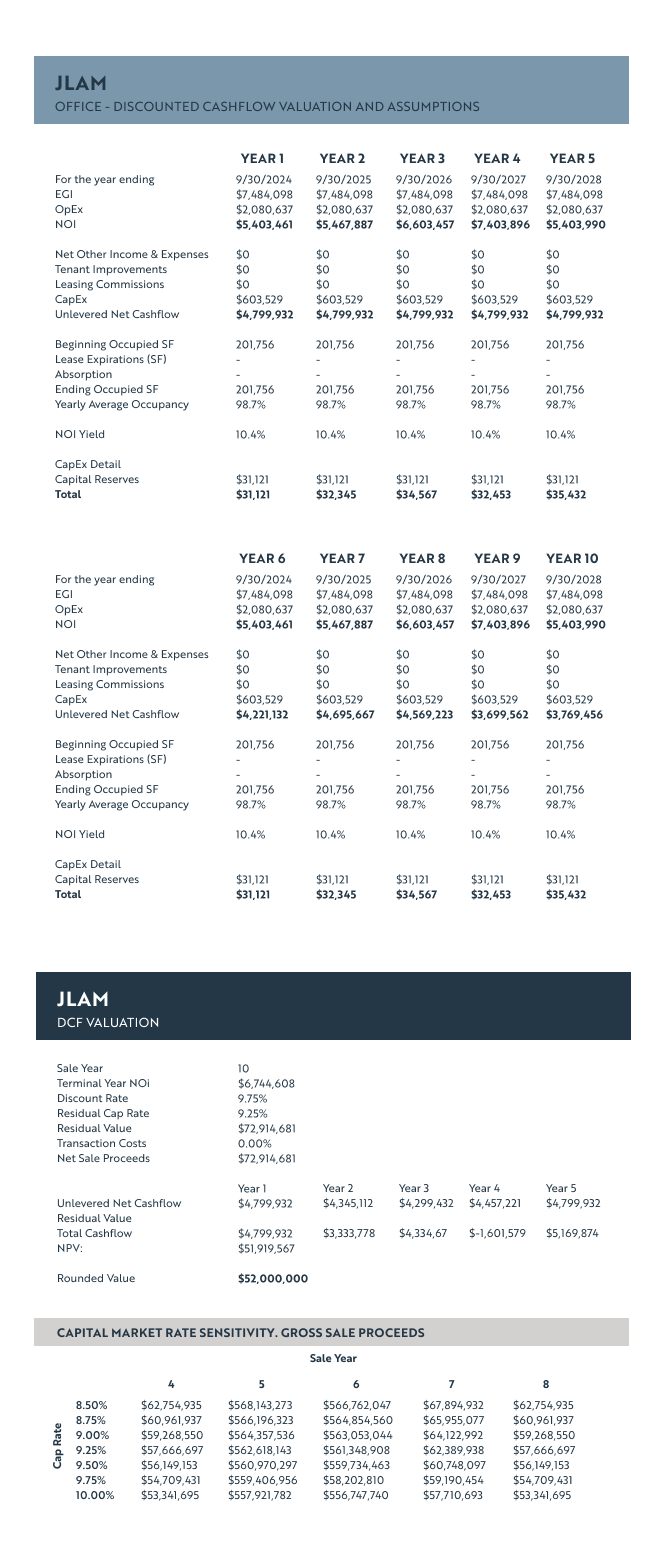

The DCF method goes beyond the 12-month horizon of the direct cap rate and allows flexibility in choosing the period for valuation. It takes into account the expected cash flows over a specified hold period, including income, operating expenses, capital expenditures, occupancy changes, and potential exit conditions. In essence, it factors in the time value of money, which is crucial for assessing long-term investments. DCF offers more precision for valuations, especially for properties that require significant leasing efforts or capital improvements to reach stabilization. The key variables in this method are the discount rate and residual cap rate, which can significantly impact the property’s valuation.

External Appraisal

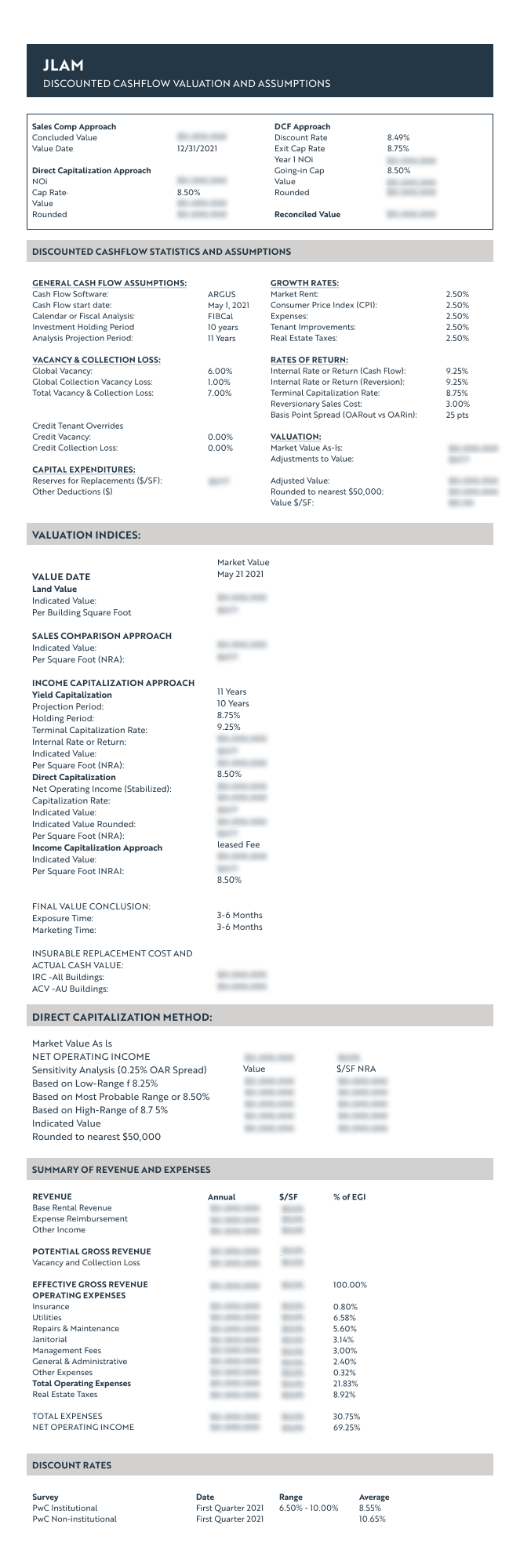

An external appraisal involves engaging an independent, licensed professional appraiser to determine a property’s value. One scenario that requires external appraisal is if the property undergoes a transaction like a sale or refinance. In this case, an external appraisal will typically be required by the lender and will factor into how much financing will be provided (for the acquisition or refinance).

External appraisers conduct a study of the property, including market data and property attributes, and utilize a combination of valuation methods—typically the sales comps, direct cap, and DCF methods—to derive a property’s value. Appraisals can include multiple value determinations, such as “As-Is” (the value of the property in its current state), “As-Complete” (the value of a development project once it is completed), or “As-Stabilized” (the value of a development or repositioned property once it has reached a stabilized occupancy level). These valuations methods are an important part of our investment management process, as they indicate the investment performance, but also impact our hold/sell analysis and exit strategy planning. Given property conditions and market dynamics can change, valuations can change over time. What do we do then?

Why did the valuation change?

Real estate valuations are subject to various factors that can cause fluctuations. These factors include:

- Interest Rates: Changes in interest rates can impact borrowing costs and, subsequently, property values.

- Cap Rates: Cap rates reflect the expected rate of return on an investment property and can fluctuate due to market dynamics.

- Market Dynamics: Market conditions, such as the impact of remote work on office spaces, can influence property valuations.

- Age and Condition of the Property: Older or poorly maintained properties may require more capital investment, which can lower values.

- Occupancy Changes: A drop in occupancy, such as a major tenant leaving, can significantly affect a property’s value. Conversely, increases in occupancy can enhance a property’s value.

- Rents: An increase in market rents (such as during periods of inflation) can increase a property’s value, while falling rents can impair a property’s value.

At JLAM, we update our valuations quarterly to account for these factors. Our valuation policy also involves revaluing existing loans (if they are assumable) using current swap rates for their respective maturities. Although fluctuations in valuations are meaningful, they do not necessarily result in a realized gain or loss, as some property’s may be held for many years to come. Instead, they provide insight into the current value of investments.

How is my investment protected against valuation fluctuation?

Real estate investments are not just about the number—it’s also about foresight and strategy. We structure our contracts and deals to protect against unexpected risks, which can cause valuations to fluctuate. By including termination penalties, recapture fees, and other safeguards, we seek to protect our investors’ interests in various scenarios. Our quarterly valuation updates provide our investors with a clear picture of their real estate investments, enabling them to make informed decisions about their portfolios. We understand that each investor has unique goals and risk tolerance. By providing comprehensive and transparent valuations, we empower our clients to make choices that align with their financial objectives. Whether they need to plan for tax implications, forecast future distributions, or reallocate assets, our valuations serve as a valuable tool for their financial strategies.

Does the investment type matter for valuations?

Yes—in fact, we use a unique method for our different investments because not every method is applicable to every type of property. They are:

- For-Sale Residential Development: JLAM uses the Discounted Cash Flow (DCF) method, exercising prudent judgment as specified by IPEV. The DCF method helps project expected cash flows for residential development investments.

- Other Real Estate Assets While Under Development: For properties in the initial development phase, JLAM carries the investment at net book value. The DCF method is utilized when management gains sufficient visibility into the asset’s performance.

- Commercial Real Estate: Valuing commercial real estate equity investments involves multiple techniques such as projected net operating income, DCF, direct capitalization method, comparable sales transactions, and more. The choice of method is guided by prudent judgment and the specifics of each investment.

What else should I know about valuations?

To ensure the accuracy and fairness of valuation, JLAM has a Valuation Committee responsible for reviewing the valuation process and standards. This committee comprises at least two members and plays a crucial role in the oversight of valuation practices.

The Valuation Committee has the discretion to engage external advisors as needed to enhance the valuation process. This ensures the valuations are unbiased and objective, benefiting accredited investors, RIAs, and family offices.

JLAM assigns an “owner” to each investment, who actively monitors the investment’s performance, interacts with local operations teams, and reports any changes in valuation. This approach ensures diligent oversight and reporting.

JLAM’s valuation process involves multiple steps, from initial valuation by the investment owner to reviews by senior management and the Valuation Committee. This multi-step process helps in ensuring accuracy and consistency in valuations.

The Valuation Committee retains the discretion to review and modify the Valuation Policy as necessary to align with the best industry standards. This commitment to continuous improvement benefits all stakeholders involved, including accredited investors, RIAs, and family offices.

Our Valuation Policy is a comprehensive framework that adheres to international best practices while accommodating the needs of accredited investors, RIAs, and family offices. It emphasizes transparency, diligent oversight, and adaptability, providing stakeholders with confidence in the accuracy of valuations and supporting informed decision-making in the world of private capital investments. For more information about our valuations, schedule a meeting with us.

*This blog is a general overview of JLAM’s valuation policy and is not intended to be a complete representation of the full policy. Contact JLAM for more information. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results, and there can be no assurance, and clients should not assume, that future performance will be comparable to past performance. Metrics updated as of June 30, 2023. JLAM does not provide tax, legal, investment, or accounting advice. This website has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment, or accounting advice. You should consult your own tax, legal, investment, and accounting advisors before engaging in any transaction. Any third-party information contained herein is from sources believed to be reliable, but which we have not independently verified.